Agentia is a provider of quality managed account-based solutions designed to meet your client’s needs. Our solutions provide all of the efficiencies of an MDA and more, without the licensing requirements or the legislative complexity.

We collaborate with great advice businesses to build and implement our cutting-edge managed account solutions to drive your advice business to the next level.

Not sure if we have a solution that is right for you? Go to our blog page and take the 2 minute quiz.

Book a Strategy Call

Investment Solutions

Advisors & Accountants

Our Approach

Our Approach

Are you a financial adviser, licensed accountant or self-managed super fund specialist looking to drive efficiency in your practice whilst offering a solution that will ‘wow’ your clients?

If the answer is yes, you’ll already understand that now, more than ever, the financial services industry has become increasingly regulated and compliance driven making it ever more critical to drive efficiency into every aspect of your practice whilst keeping your ‘client’s best Interest’ at the heart of everything you do. You must not only have an ethos of ‘best interest’ but it must be supported and evidenced in your professional practice.

At Agentia, we understand the challenges confronting the advice industry and we build tailored Managed Account-Based Solutions designed for your business to suit your client’s needs..

View Our Investment Solutions

A Unified Approach

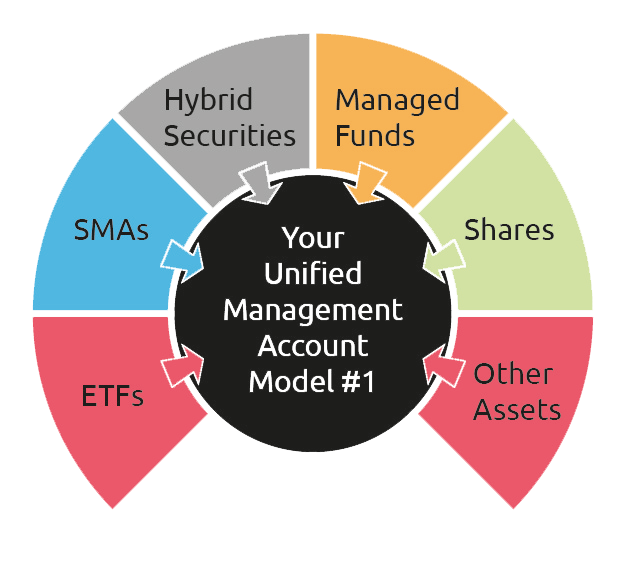

Our investment solutions are made up of a range of different investment options that include Separately Managed Accounts (SMAs), Exchange Traded Funds (ETFs), listed and unlisted managed funds, direct shares, hybrid securities and alternative investments.

Our Investment Solutions

Why Agentia?

We are not your regular managed account provider

Managed account investment solutions are quickly becoming the choice of forward thinking professional advice practices. At Agentia, we have developed one of the most advanced managed account-based solutions in the market. This approach provides each client with a combination of professionally managed investment models matched and maintained in accordance with their risk profile requirements and their investment needs.

What does this mean for your advice business?

Each change in the underlying asset allocation or investment is handled by us and all client portfolios are reviewed by a professional investment analyst who has access to a range of investment tools to monitor, review and stress test your client’s investment portfolios.

We make the portfolio changes and all client portfolios are updated at the same time. You don’t complete any investment forms to redeem investments. There are no advice documents to send. You don’t wait for fund managers to sell down so you can reinvest client funds. There is no need to follow up your clients to make sure they have approved their portfolio changes. As a result, you will reduce costly administration processes and eliminate potential mistakes in your back office.

We do all the rebalancing of client portfolios and we must do this in accordance with our mandate which is set out in the PDS. No more rebalancing unless you want to change risk profiles. Reduced business risk as all client portfolios are always within their risk profile or risk v return requirements.

If you do want to change risk profiles then you can select another Agentia Model which will include the same investment managers but have a different allocation to growth v defensive assets. This will simplify the change in the client’s portfolio and significantly reduce their transaction costs and CGT outcomes, as well as preserve much of their franking credits in the Australian equity component of their investment portfolio.

Agentia Models reduce the compliance burden and compliance risk, significantly reduce back office administration, reduce business risk and free up an adviser’s time to concentrate on the client relationship which will help grow the business.

Speak with an investment expert

What Do You Get?

We offer much more than your standard SMA

A very competitively priced managed account-based solution to match your business model.

A range of client portfolios that will all be managed professionally and efficiently by a team of highly qualified investment analysts.

Every client in every portfolio will experience the correct changes all simultaneously and you, the adviser, can choose to communicate this however you wish without an advice document.

No SoA or RoA is required because the investment change has been implemented by us as managers of an approved managed investment scheme protected by a Responsible Manager and managed in accordance with a registered PDS.

Your clients will not be out of the market while these changes take place and we will update all client portfolios long before even the most efficient adviser office could achieve the same outcome.

We manage all the portfolio changes and provide you with updates about all changes as soon as they are made so you can disseminate this information to your client base in a timely manner.

Your client portfolios are maintained in accordance with their risk profile or risk v return requirements which eliminates the need to do portfolio re-balances.

Our portfolios will maintain growth v defensive positions in a band of no more than plus or minus 5 percent.

Access to an adviser website that will provide you with monthly and quarterly performance reports for each model, regular portfolio updates, a list of portfolio holdings including what is in the portfolio and why it is there, our asset class valuation dashboard and market blog.

Access to our research analysts and members of our Investment Committee.

View Our Investment Solutions

What do your client’s get?

We offer a total managed account-based investment solution

Our low cost, professionally managed investment portfolios that are monitored and maintained by a team of highly qualified investment analysts.

Investors have online access 24/7 to their investment portfolios via an informative and intuitive platform.

They are the beneficial owners of their investment portfolios.

They can see all trades in their portfolio which are netted out across all accounts on platform and traded under a single custodial HIN. This results in significant cost savings for all our investors.

All listed securities which are not netted out and are traded incur a very low brokerage fee of just 0.055% including GST. That is just $55 for every $100,000 worth of trades.

The Agentia investment portfolios are predominantly low turnover and we take CGT and franking credit positions into account before we make any changes in our portfolios to preserve franking credits and reduce CGT outcomes.

All trades in your client’s investment account are managed at a tax parcel level to minimise their personal CGT outcomes.

All investment clients have access to a wide range of reports which can be customised by their adviser. These include portfolio valuation, income and tax credits, investment movements, income and yield, tax summary, realised and unrealised CGT positions as well as online tax reporting at the end of the financial year.

View Our Investment Solutions

Our

Investment

Solutions

Managed Account System

Learn More

Managed Account Builder

Get all the benefits of managed accounts plus access to institutional grade research expertise, preferential pricing, an award winning managed account platform and the ability to design your own managed account solution that matches your in house risk profiles and investment process.

Learn More

Custom Managed Account

Get your own managed account solutions constructed from the ground up using our institutional grade research, our dedicated investment and asset allocation committee and an award winning administration platform.

You will get preferential pricing from fund managers and the platform administrator, as well as customised investment models designed for your clients to suit your business model.